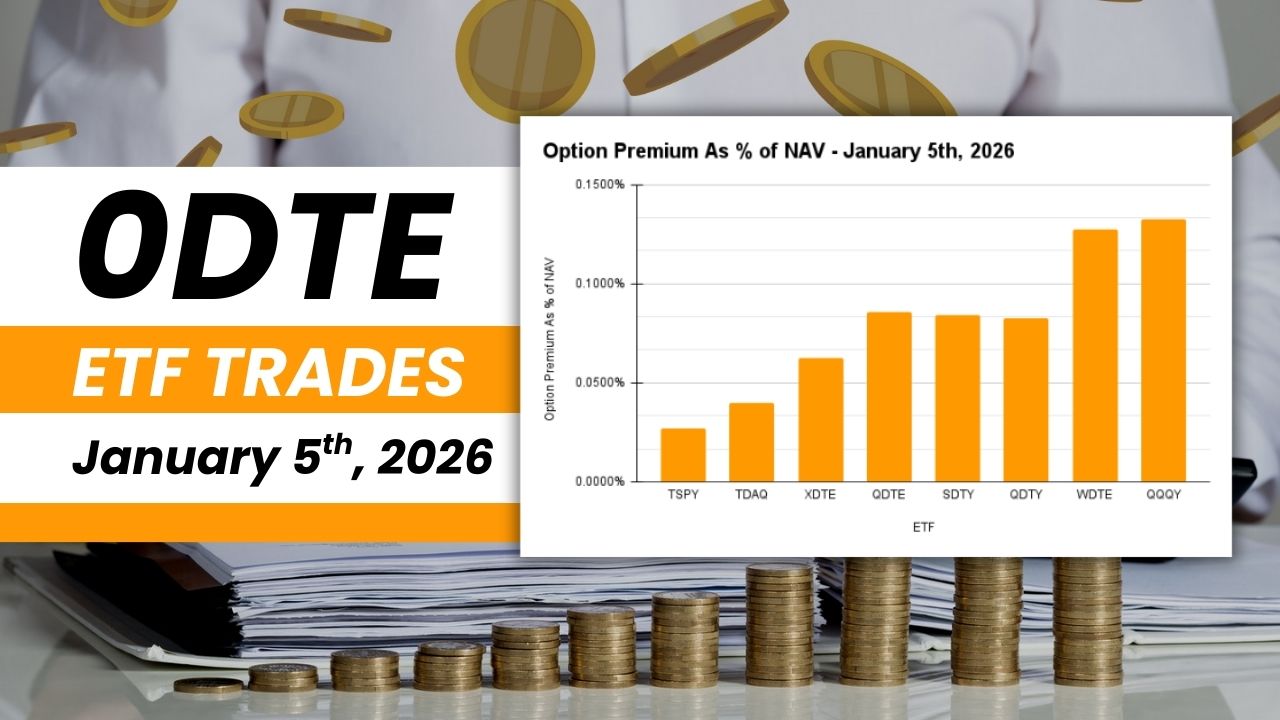

S&P 500 and NASDAQ 100 0DTE ETF Trade Log — January 5th, 2026

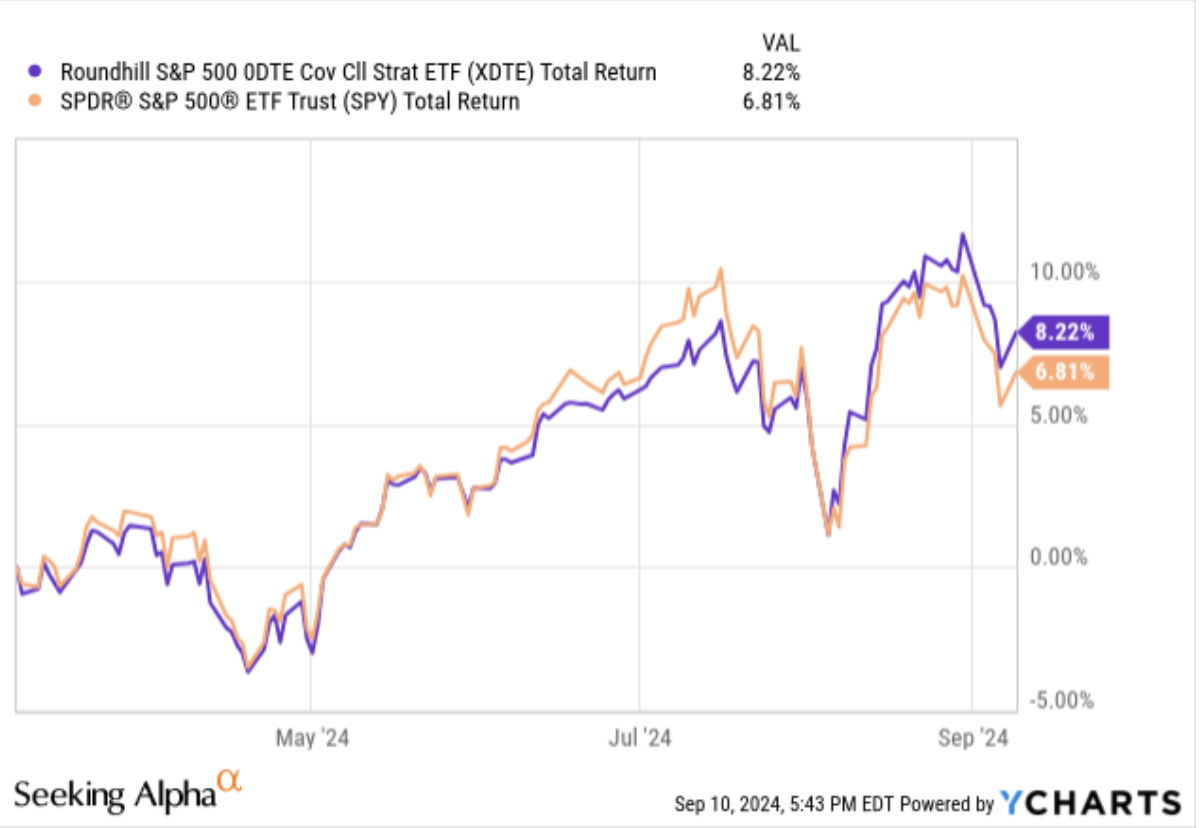

In continuation with my last post, where I discussed how the NEOS equity income ETFs are currently positioned, I wanted to start a new series where I track the daily trades of various 0 days-to-expiry (0DTE) income ETFs. For context, 0DTE references how the options that these funds sell are generally set to expire on the day … Read more