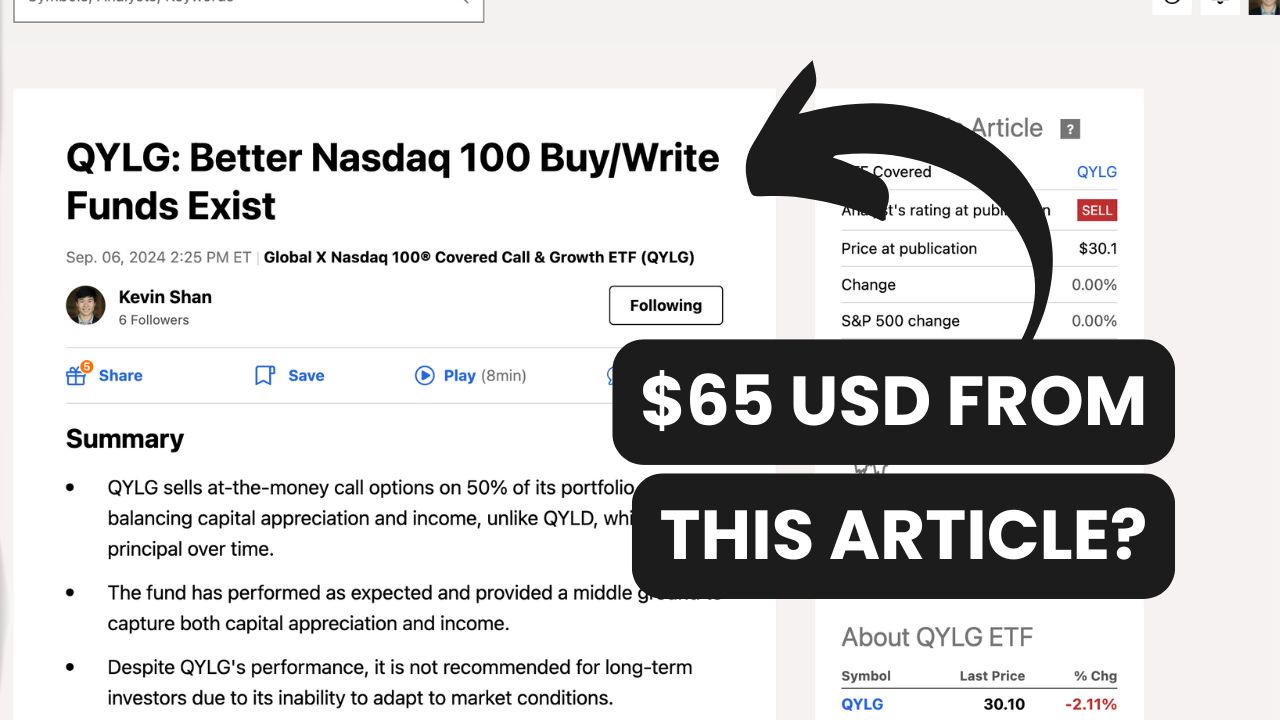

How Much Seeking Alpha Pays For Your Articles (Earnings Per View)

Those of you who have been following me may have seen a few posts from me about writing on Seeking Alpha. This Site Pays $45+ per Article With No Viewers for Your Articles on Investing How To Publish Your First Article on Seeking Alpha (and Earn $45+) This platform is like Medium but exclusively for investing … Read more