At the start of December 2022, I was completely revamping my schedule to include more time spent on learning to improve myself and produce more content here on Guru Audit. After seeing how much time I could allocate to learning, I then looked at what I wanted to learn. I decided investing/finance and computer science would be the topics I started with.

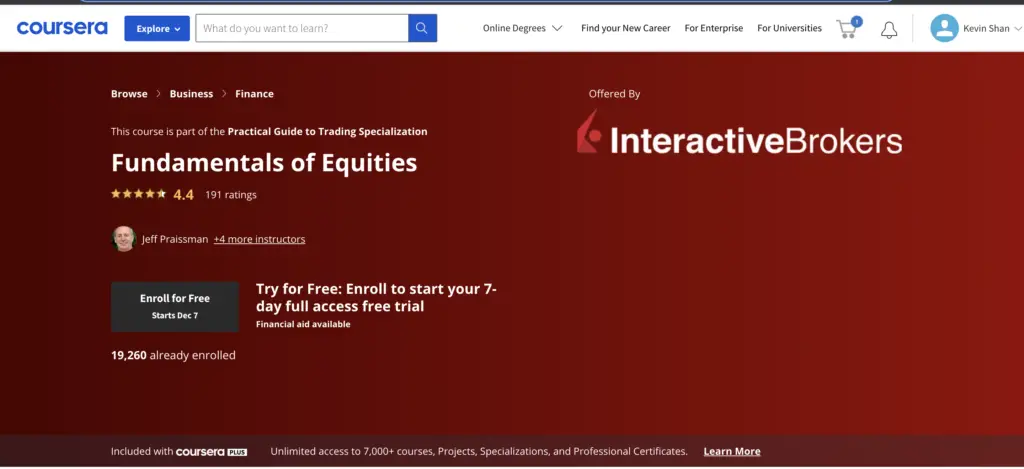

While browsing Coursera for courses to take, I came across Interactive Brokers’ Practical Guide to Trading Specialization and the first course within the specialization, the Fundamentals of Equities course. Since I saw Interactive Brokers’ success as a trading platform, I decided to give the course a go.

And after just a couple of days, I’ve finished the Interactive Brokers course and have the pleasure of writing my Coursera’s Fundamentals of Equities course review. Let’s get started.

Table of Contents

What Is Coursera’s Fundamentals of Equities Course?

Interactive Brokers, a top online trading platform, offers the Fundamentals of Equities course on Coursera. This is the first course in the Interactive Brokers’ Practical Guide to Trading Specialization on Coursera.

As the course title suggests, the course aims to teach you the fundamentals of equities in the stock market. By the end of the course, you should have a basic understanding of what stocks are, a company’s financial statements, and various market drivers.

I will go through the Fundamentals of Equities course curriculum in the below section.

Fundamentals of Equities Course Curriculum

All the courses I have taken on Coursera have content organized into weeks to help you pace your learning. Interactive Brokers’ Fundamentals of Equities course is no different.

Here’s a snapshot of what you’ll be learning in the Fundamentals of Equities course:

Week 1: Stocks & the Business Cycle

- About this Specialization

- About this Specialization (Video)

- Fundamentals of Equities – Overview

- Fundamentals of Equities – Overview (Video)

- Introduction to Stocks

- Intro to the Stock market (Video)

- Intro to the Stock market (Quiz)

- IBKR Free Trial – Trader Workstation Platform (Article)

- What is the Business Cycle?

- Introduction to the Business Cycle (Video)

- Introduction to the Business Cycle (Quiz)

- Business Cycle Market Commentary (Article)

- Intro to Sector Investing

- Sectors – Using State Street’s Select Sector SPDR Exchange Traded Funds (Video)

- SPDR ETF Features (Article)

- Investable Sectors

- The Economy in Investable Sectors (Video)

- SPDR ETF Features (Article)

- Stocks & the Business Cycle – Graded Assessment

- Stocks & Business Cycle (Quiz)

Week 2: Fundamental Analysis

- Practical Demo of Stock Fundamentals

- Practical Demo of Stock Fundamentals (Video)

- Some Fundamental Definitions (Article)

- Practical Demo of Stock Fundamentals (Quiz)

- Optional – Instructions to download Trader Workstation (Article)

- Financial Statements: Balance Sheet

- Balance Sheet (Video)

- Balance Sheet (Quiz)

- More about Balance Sheets (Article)

- Financial Statements: Income Statement

- Income Statement (Video)

- Income Statement (Quiz)

- More about Income Statements (Article)

- Financial Statements: Cash Flow

- Cash Flow Statement (Video)

- Cash Flow Statement (Quiz)

- More about Cash Flow Statements (Article)

- Trading and Analysis – Fundamental Analysis

- CME Group-Trading and Analysis & Videos (Article)

- Fundamental Analysis – Graded Assessment

- Fundamental Analysis (Quiz)

Week 3: Funds

- Intro to Mutual Funds

- Introduction to Mutual Funds (Video)

- Introduction to Mutual Funds (Quiz)

- Mutual Funds vs. ETFs: What’s the Difference? (Article)

- Search for Mutual Funds (Article)

- Mutual Fund Trading, Pricing and Fees

- Mutual Fund Trading, Pricing and Fees (Video)

- Mutual Fund Trading, Pricing and Fees (Quiz)

- Funds – Graded Assessment

- Funds (Quiz)

- Fundamentals of Equities Course Conclusion

- Fundamentals of Equities – Course Conclusion (Video)

In Week 1, as the title suggests, you will learn about stocks and the business cycle. This is where you’ll learn how various economic factors affect the market and how market sectors, companies, and investors react.

Week 2 will take you into a company’s financial statements and help you understand what various items on a company’s Balance Sheet, Income Statement, and Cash Flow Statement mean. The “Trading and Analysis – Fundamental Analysis” section of Week 2 will also lead you to a third-party website where you’ll take seven introductory lessons about short-term trading and its players.

Week 3 is the final and shortest week, where you’ll get an introduction to mutual funds and ETFs. This section will give you an introductory understanding of how mutual funds operate and how to engage with them.

Now that you have an overview of the course, let’s jump into what I like and dislike about Coursera’s Fundamentals of Equities course.

==> Get The Fundamentals of Equities Course Here!

What I Like About The Fundamentals of Equities Course

1. Professional Course With Completion Certificate Offered By A Renowned Company

If you didn’t know this already, Interactive Brokers is a publicly-traded company. Coursera is also a platform renowned for partnering with top universities and companies worldwide to provide courses. So what you can generally expect from Coursera courses are that they’re professional and come with completion certificates that can be displayed wherever you’d like.

2. Structure Of The Course

This goes along with point number one, as I’m a big fan of how Coursera courses are structured. Every class has a combination of video, reading lessons, quizzes, and graded assessments. These quizzes make it much easier to remember what you have learned as it forces you to look back and think about what the instructors have been teaching you.

What I Don’t Like About The Fundamentals of Equities Course

1. Definitions Without Context

For a very good reason, it was tough to remember the things I had learned in the Fundamentals of Equities course. Taking this course is like trying to learn the English language by reading a dictionary. Information was getting splashed on my face without context or explanation on why it was necessary, making it challenging to keep engaged.

2. Lack Of Depth In Content

Along with a lack of context behind the information, there was a general lack of information in the course. For example, when taking the Fundamental Analysis section of the course, I often found myself frustrated when the instructors only explained what items on a company’s financial statements were.

They would talk about how the income statement shows how much money a company is making but never talk about what may be good/bad things to look for on an income statement.

3. Price Is Too High

The first two cons of the Fundamentals of Equities course ultimately combine to create the third con of the price being too high. You would much instead read a bunch of articles on Investopedia than pay $66 CAD (~$50 USD) per month to take this course.

Now that being said, I will admit that I have not taken the other four courses in the specialization that the Fundamentals of Equities course is part of yet. You get the whole Practical Guide to Trading Specialization when you’re paying $66 CAD per month. My price opinion will change depending on how good the rest of the specialization is.

You can also get this course free if you have a Coursera Plus subscription. The subscription costs $59 USD per month or $399 USD annually and gives you access to nearly all the courses on Coursera.

But if you’re considering getting a Coursera Plus subscription just to take the Fundamentals of Equities course, forget about it.

How Much Does The Interactive Brokers’ Fundamentals of Equities Course Cost?

As I mentioned above, the Interactive Brokers’ Fundamentals of Equities course will cost you $66 CAD ($50 USD) per month. You will be paying for the Practical Guide to Trading Specialization, which will give you access to the Forex – Trading Around the World, U.S. Bond Investing Basics, and Derivatives – Options & Futures courses with the Fundamentals of Equities course.

You can also spend $59 USD per month or $399 USD annually to get a Coursera Plus subscription which would give you access to this course and many more in Coursera’s catalog.

Is Coursera’s Fundamentals of Equities Course Worth It?

You’ve probably guessed it by now, but I do not think Coursera’s Fundamentals of Equities course is worth it. The course lacks context for its content and is missing in-depth content to the point that I’m asking myself if I’ve learned anything from this course.

Spending $66 CAD (~$50 USD) per month to take this course is a waste of money. And even if you already have a Coursera Plus subscription or want to take just the audit version (just content, no certificate or assessments) of the course, you will find that your time could be much better spent watching YouTube videos or reading blogs on investing.

==> Get The Fundamentals of Equities Course Here!

Coursera’s Fundamentals of Equities Course Review

And that’s it for my Coursera’s Fundamentals of Equities course review. Have you taken the Interactive Brokers’ Fundamentals of Equities course? What course would you like me to review next? Let me know in the comment section below!

Coursera's Fundamentals of Equities Course Summary $66 CAD/month

-

Content

-

Price

-

Bonuses

Summary

Interactive Brokers’ Fundamentals of Equities course on Coursera is the first course a part of the Practical Guide to Trading Specialization. The aim of the course is to teach you the basics of the stock market and economic factors. Unfortunately, the content is severely lacking for the amount of money one spends on the course. On a positive note, however, the content you learn is accurate, and completing this course does come with a reward in the form of a certificate.