In continuation with my last post, where I discussed how the NEOS equity income ETFs are currently positioned, I wanted to start a new series where I track the daily trades of various 0 days-to-expiry (0DTE) income ETFs.

For context, 0DTE references how the options that these funds sell are generally set to expire on the day of selling. The funds that I will be tracking are also index-linked, where they have exposure to the underlying S&P 500 or NASDAQ 100 and sell options on those respective indices.

The S&P 500 funds that I will track are as follows:

- TappAlpha SPY Growth & Daily Income ETF (TSPY)

- Roundhill S&P 500 0DTE Covered Call Strategy ETF (XDTE)

- YieldMax S&P 500 0DTE Covered Call Strategy ETF (SDTY)

- Defiance S&P 500 Target 30 Weekly Distribution ETF (WDTE)

And here are the NASDAQ 100 funds:

- TappAlpha Innovation 100 Growth & Daily Income ETF (TDAQ)

- Roundhill Innovation-100 0DTE Covered Call Strategy ETF (QDTE)

- YieldMax Nasdaq 100 0DTE Covered Call Strategy ETF (QDTY)

- Defiance Nasdaq 100 Target 30 Weekly Distribution ETF (QQQY)

Ultimately, the goal of sourcing this data every day is to increase the quality of the ETF analysis that we see online.

As someone who covers and also invests in many of these high-yielding ETFs myself, I thought it would be extremely helpful to know what’s going behind the scenes of these ETFs.

Thus, it is a wonderful blessing that these ETF providers all provide the opportunity to see their intraday trades.

And to make this data more relevant, I’ve contextualized the trades with ongoing market conditions such as the index opening levels.

Table of Contents

S&P 500 and NASDAQ 100 Contextual Information

SPX Open and IV — January 5th, 2026

On January 5th, 2026, the S&P 500 (also referenced as SPX) opened at a level of 6,892.19, according to Yahoo! Finance.

The 30-day implied volatility (“IV”) level also sits at approximately 12.2, according to Market Chameleon.

NDX Open and IV — January 5th, 2026

As for the NASDAQ 100 (NDX), the opening level on January 5th, 2026, was 25,471.79. 30-day IV levels were at 17.4.

With these numbers in mind, we can take a look at some of the trades from TappAlpha, Roundhill, YieldMax, and Defiance fund managers.

S&P 500 0DTE ETF Options Activity

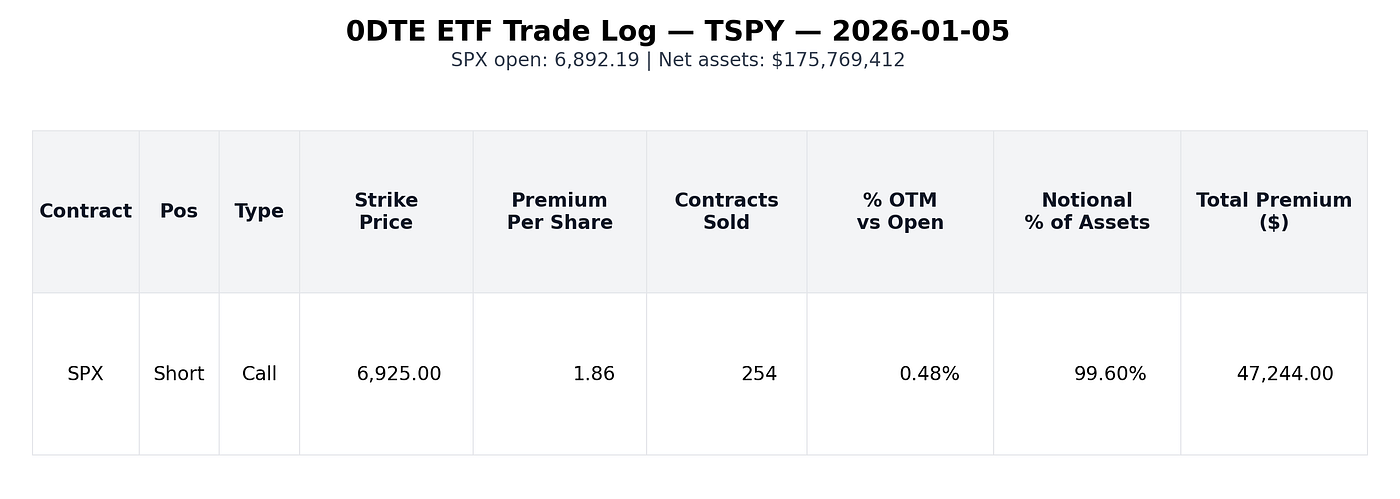

TSPY Options Activity — January 5th, 2026

On January 5th, 2026, TSPY sold one call option about 0.48% out-of-the-money (“OTM”), covering essentially 100% of its portfolio in notional value.

Based on the 254 contracts sold and the $1.86 option premium per share, TSPY generated about $47,244.00 on the fifth.

That means TSPY generated approximately 0.0269% of its NAV in option premiums from its trade on January 5th, 2026.

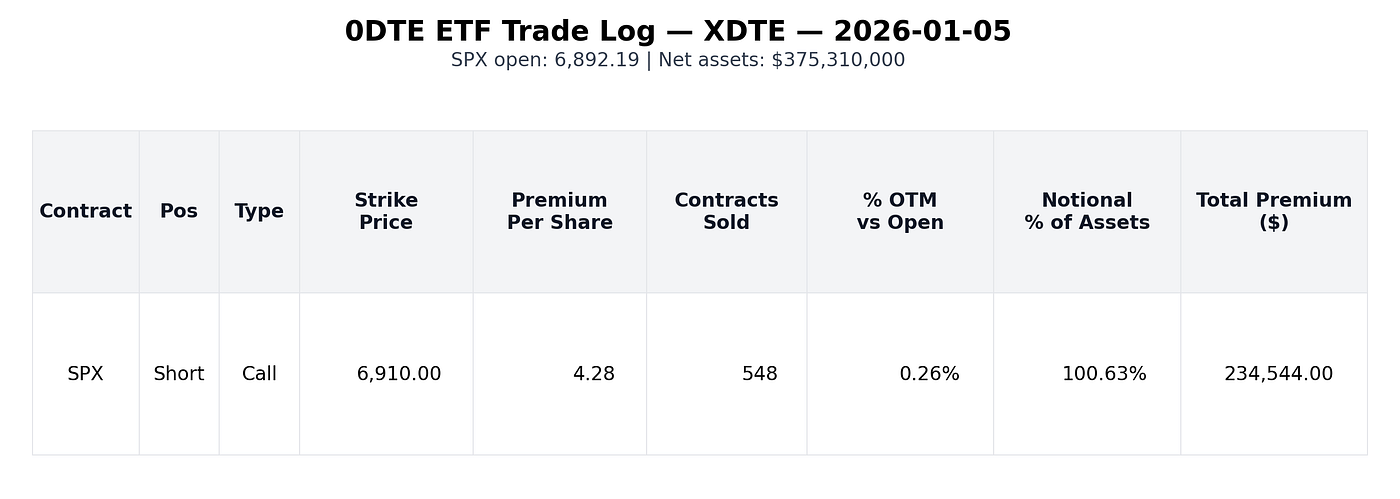

XDTE Options Activity — January 5th, 2026

Compared to TSPY, XDTE generated much more in option premium relative to its NAV, with its $234,544 representing approximately 0.0625% of net assets.

This is due to a strike selection of 6910 that’s closer to the SPX’s opening price, as well as the trade covering about 100.63% of assets in notional value.

The option premium per share was $4.28, and the number of contracts sold was 548.

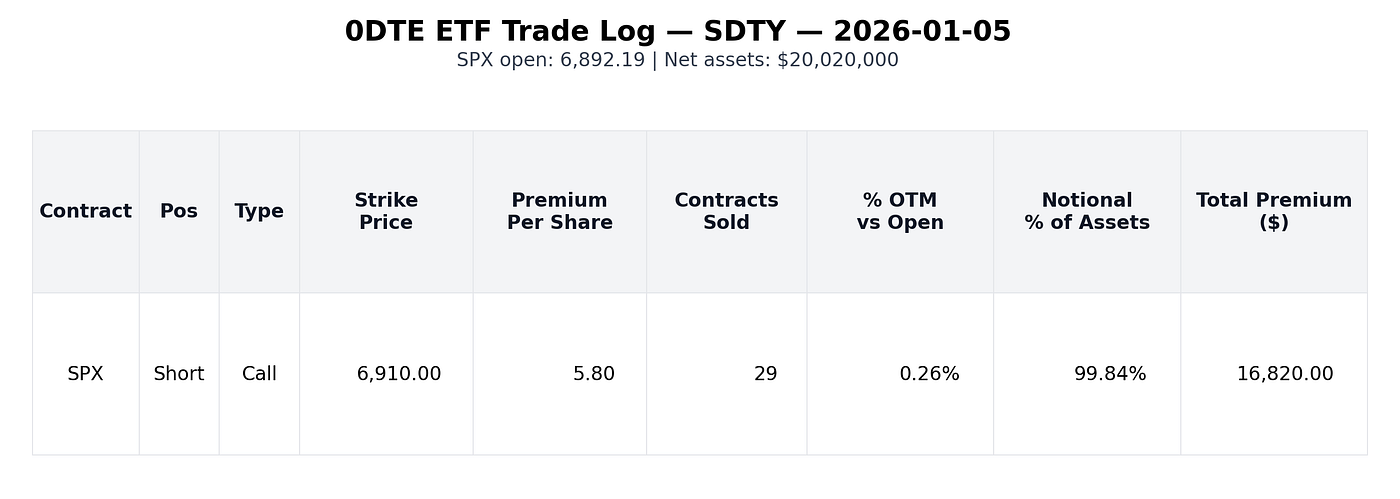

SDTY Options Activity — January 5th, 2026

SDTY and YieldMax decided to take a very similar approach as XDTE, with its strike price being set at the same number of 6910.

SDTY, however, was able to generate slightly higher premiums per share at $5.80, which resulted in an even higher yield compared to XDTE at 0.0840% of net assets.

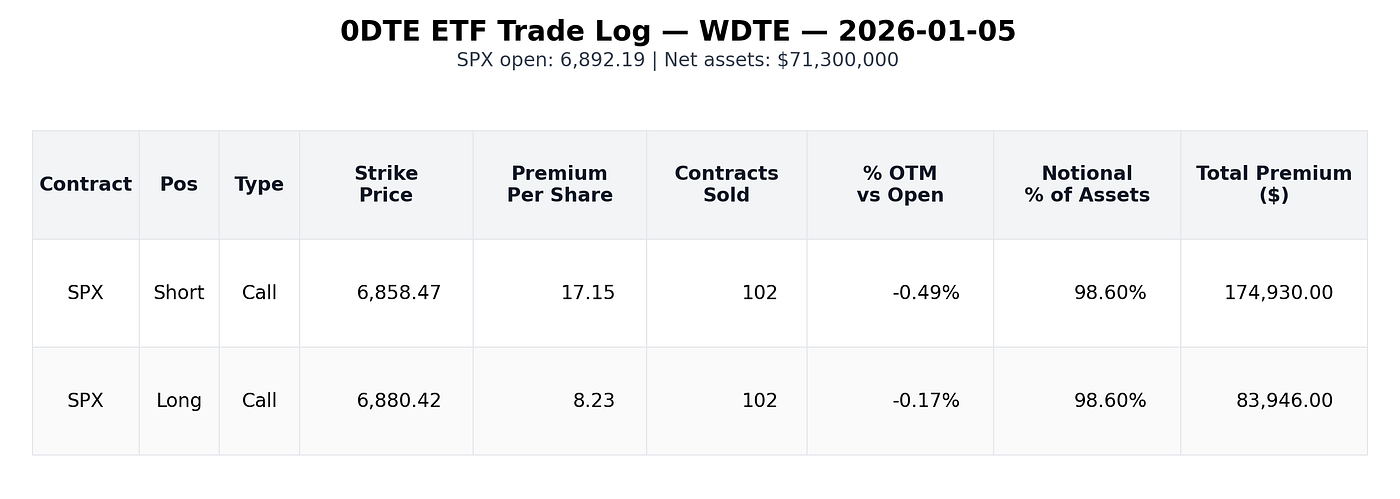

WDTE Options Activity — January 5th, 2026

As for WDTE, it’s the fund most different from the others as it decided to sell a call spread, which involves selling a call option closer to the money and buying one further OTM to limit the loss of the upside.

Both options were actually in-the-money (“ITM”) relative to the SPX’s opening levels. This allows WDTE to generate significantly higher premiums despite also buying a call option.

Net premiums were $90,984.00, which represents 0.1276% of WDTE’s net assets — the highest percentage of the SPX 0DTE funds.

NASDAQ 100 0DTE ETF Options Activity

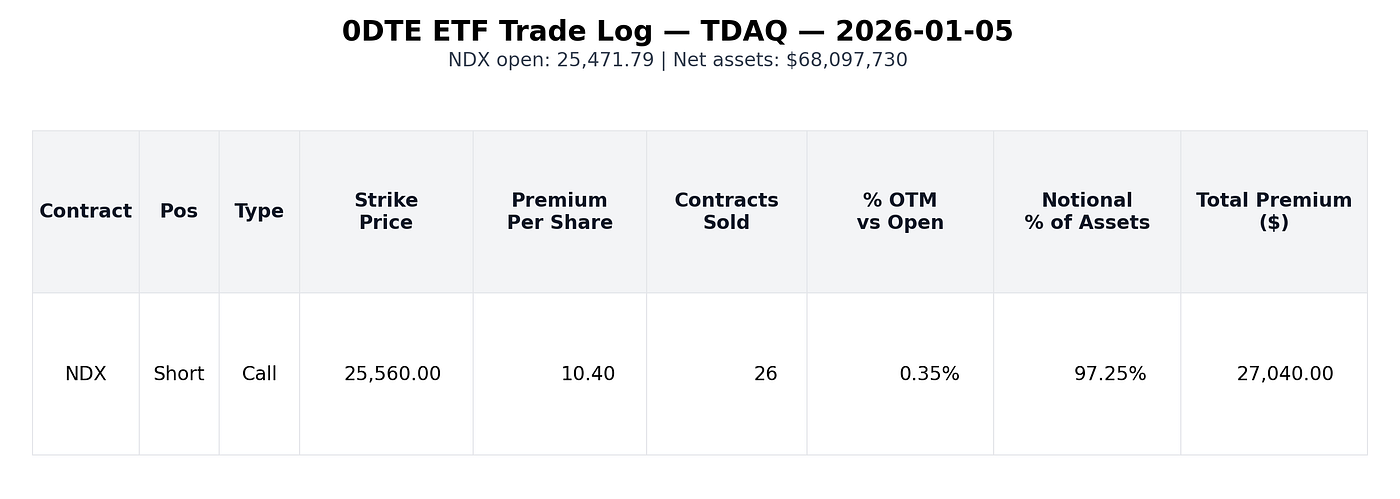

TDAQ Options Activity — January 5th, 2026

Now onto the NDX 0DTE funds, beginning with TDAQ, we’ll see that it has sold 26 contracts of an option with a strike price of 25,560.

This strike is about 0.35% OTM relative to the NDX’s opening level, and the total premiums generated by the fund are about 0.0397% of its net assets.

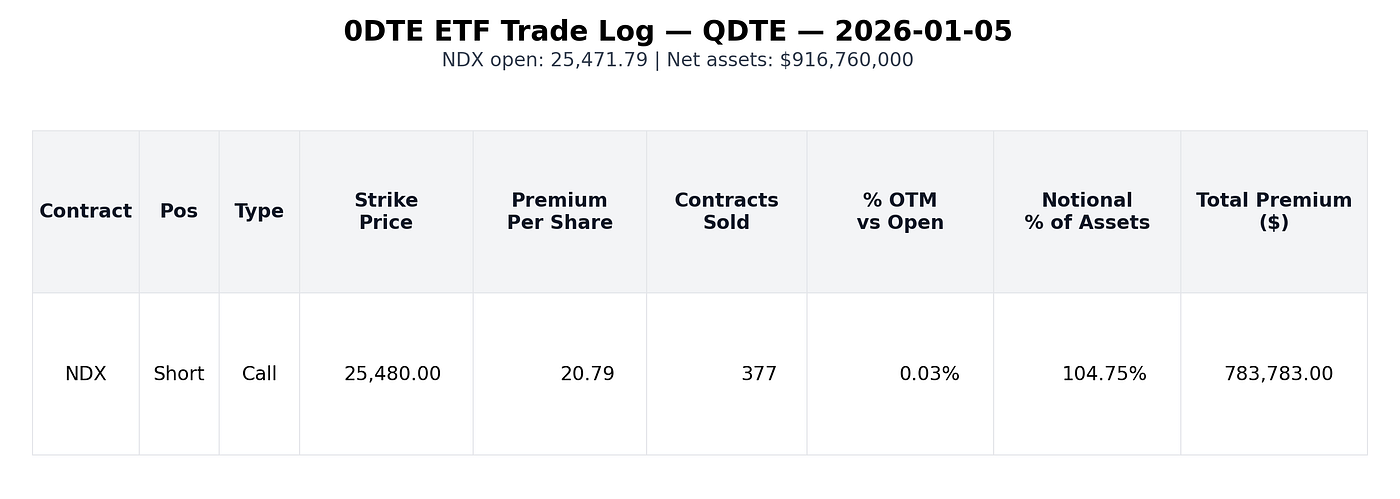

QDTE Options Activity — January 5th, 2026

Just like XDTE, Roundhill has also been more aggressive with its call strategy on QDTE compared to TappAlpha and chose a 25,480 strike price that’s essentially at-the-money (“ATM”).

This trade also covers a higher notional value and generated approximately 0.0855% of the fund’s net assets.

QDTY Options Activity — January 5th, 2026

On YieldMax’s side, QDTY has sold two call options with total premiums representing 0.0828% of its net assets.

One of these call options was NASDAQ 100 mini option (XND), and was likely used due to QDTY’s size and to adjust its risk profile.

Both strikes were OTM but only about 0.11% and 0.27% for the XND and NDX options, respectively.

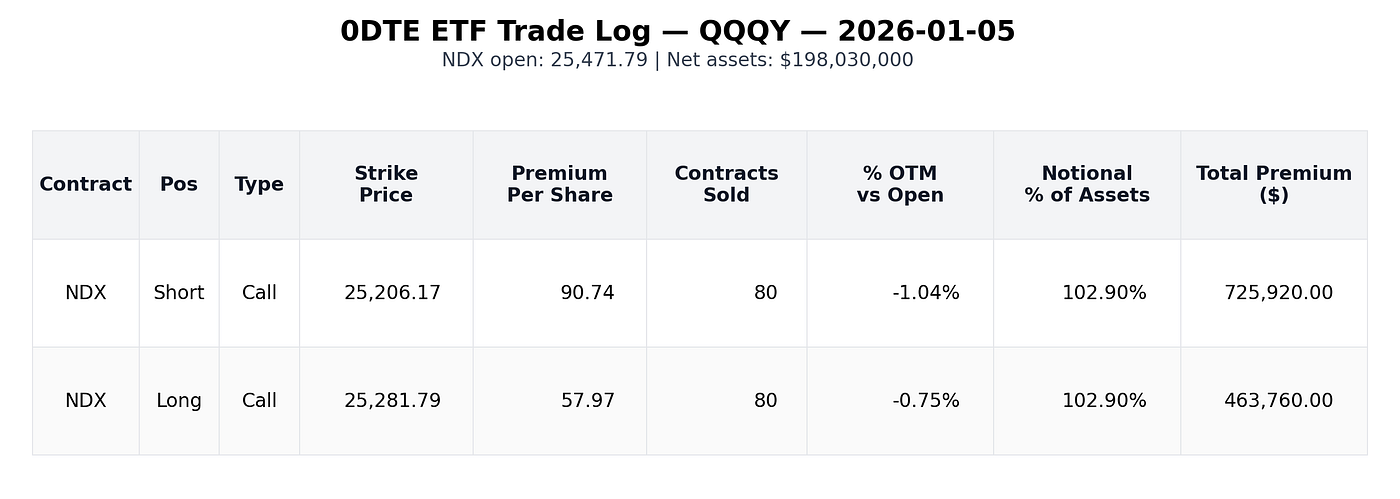

QQQY Options Activity — January 5th, 2026

And finally, we have QQQY. Just like WDTE, QQQY has opted for strike prices ITM and a call spread strategy.

Its short call is at a strike price of 25,206.17, and it generated $725,920 in option premiums.

Its long call is at a strike price of 25,281.7,9 and it cost the fund $463,760 to purchase.

Total net premiums resulted in 0.1324% of net assets.

Data Interpretation and Disclosures

Now, it’s imperative that I mention a couple of disclosures with this data and clarify some points.

Please note that these charts do not necessarily reflect what’s exactly happening behind the scenes.

The data is only as good as what the ETF providers disclose. Some data collection methodologies should also be explained.

Today’s data report was pulled at 1 PM EST, and all data was pulled from the fund providers’ respective webpages:

- TSPY | https://www.tappalphafunds.com/etfs/tspy#holdings

- TDAQ | https://www.tappalphafunds.com/etfs/tdaq#holdings

- XDTE | https://www.roundhillinvestments.com/etf/xdte/

- QDTE | https://www.roundhillinvestments.com/etf/qdte/

- SDTY | https://yieldmaxetfs.com/our-etfs/sdty/

- QDTY | https://yieldmaxetfs.com/our-etfs/qdty/

- WDTE | https://www.defianceetfs.com/wdte-full-holdings/

- QQQY | https://www.defianceetfs.com/qqqy-full-holdings/

SPX and NDX opening prices were pulled from Yahoo! Finance, and IV levels came from Market Chameleon.

Certain data metrics like Total Premium, Notional % of Assets, and % OTM Vs. Open were all calculated based on the other data pulled and may not reflect the full accuracy of the trade.

This is most notable for the % OTM metrics, where we don’t have data on where the index levels were at when the funds actually sold their options.

As such, this data should not be relied upon as fully accurate depictions of each fund but instead, as approximations.

For more in-depth analysis on each fund, I highly recommend checking out Seeking Alpha, where many writers, including yours truly, provide breakdowns and analyses of these income funds.

Financial Disclaimer: The views in this article are the author’s personal views. This commentary is provided for general informational purposes only. It does not constitute financial, investment, tax, legal, or accounting advice or an offer or solicitation to buy or sell any securities referred to. Individual circumstances and current events are critical to sound investment planning; anyone wishing to act on this article should consult with their advisor. The information provided in this article has been obtained from sources believed to be reliable and is believed to be accurate at the time of publishing, but we do not represent that it is accurate or complete, and it should not be relied upon as such. Investing in stocks, bonds, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Their values change frequently, and past performance may not be repeated.

Affiliate Link Disclosure: You may assume all links in this article are affiliate links. If you purchase any product or service through the link, I may be compensated at no extra cost to you.

This article was originally published on Medium.com. Please click here to read it on Medium.